Your Finances Travel With You

Fall into smart finances now, so you can spring into adventure abroad! As you prepare for a study abroad program as part of your UC Berkeley experience, there’s one thing you can’t afford to leave behind: a plan for your personal finances. Whether you’re planning weekend trips or just trying to cover daily expenses, having a plan will help you make the most of studying abroad!

Hey! I’m Simone, and I studied abroad in Madrid during the spring of 2024 my junior year. I’m a Financial Wellness Coach at the Center for Financial Wellness, a peer-to-peer program housed in the Financial Aid and Scholarships Office. If you’re anything like I was, you might be wondering how you’ll afford life abroad and still stay on track financially. I’ve been there, and trust me, it’s totally doable with some pre-departure planning.

Budgeting Basics

The key to managing your finances, whether you’re at home or abroad, is to keep track of where your money is going.

- The Center for Financial Wellness offers a simple spending plan template to get you started. If you prefer digital tools, apps like Credit Karma can help you track spending in real-time.

- If you already have a budget, now’s a great time to update it with expected expenses abroad, such as housing, travel, and weekend trips. I recommend checking your UCEAP destination portal for estimated costs and then tweaking it to fit your lifestyle.

- If you have friends who’ve been to your study abroad destination, reach out for advice on average costs for food and accommodations. You can also contact UC Berkeley Study Abroad Advising office.

- Book an appointment with the Center for Financial Wellness if you want to create a personalized study abroad financial plan with one of our coaches.

In Madrid, I saved money by living in a homestay with a local family. It was not only more affordable than most apartments, but it also allowed me to practice my Spanish, immerse myself in the culture, and enjoy homemade meals. Wherever you’re heading, plan your budget ahead of time so that you’re able to enjoy the experience without financial stress!

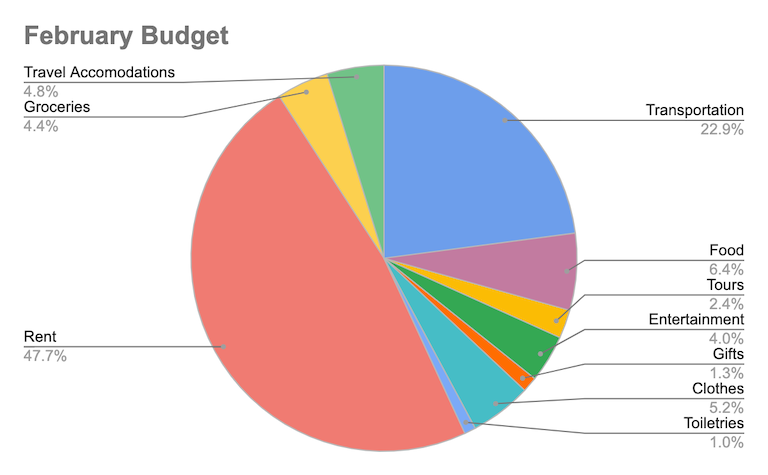

Example of monthly budget categories

Using Financial Aid for Studying Abroad

Did you know that you can use your financial aid to fund your study abroad adventure? If you’re enrolled in a UC Berkeley-approved study abroad program, the Financial Aid and Scholarships Office can apply your federal, state, and campus financial aid—just like if you were staying on campus. Your financial aid package can cover tuition, program fees, and even out-of-pocket expenses like airfare, meals, and books.

Once you’re accepted into a program, Berkeley Study Abroad notifies the Financial Aid Office, and your aid will automatically be adjusted to fit the cost of your program. In addition to financial aid, there are several scholarships, both need-based and academic, offered through Berkeley Study Abroad. Whether you’re spending a summer in Spain or a full year in Japan, there are several options to fund your trip. Find out more on the Financial Aid and Scholarships website!

Camel ride in the Sahara Desert

Credit Cards & Bank Finances

When you’re studying abroad, a travel credit card can take you far (literally). Many of these cards can help fund future adventures by rewarding you with points that can be redeemed for free flights. If you don’t yet have a credit card, applying for a student credit card is also a great option and a way to start building your credit. When choosing between credit cards for study abroad, look for one with no foreign transaction fees so you’re not paying an extra fee for every purchase internationally. Just remember—using a credit card responsibly while abroad can help you build your credit score, as long as you make all your payments on time and in full.

Tips for Using a Debit & Credit Card Abroad

- Before you depart, it’s a good idea to tell your bank you’ll be abroad so they don’t think someone stole your card and freeze the account.

- While abroad, avoid taking out cash with your credit card because you’ll be hit with very high fees. Instead, bring a debit card with no ATM fees.

- To save money when using a credit card abroad, always choose to pay in the local currency; this typically provides a better exchange rate and avoids extra fees.

- It’s a good idea to have both a credit and debit card on hand in case one doesn’t work in certain places, or if you visit shops or restaurants that only take cash.

Keeping some local currency with you is also a good idea when you’re traveling – better to be prepared than stranded without a way to get that train ticket home.

Spending time with friends in Mallorca

Start Planning Today!

During my time studying abroad in Madrid, I learned firsthand how important it was to have a solid financial plan. Managing my budget allowed me to balance daily expenses while still enjoying weekend trips and spontaneous adventures. With some thoughtful planning, you’ll be able to do the same, ensuring you can make the most out of your study abroad experience! Here is a pre-departure checklist to help you start planning today:

Study Abroad Pre-Departure Checklist

Now:

- Apply for Scholarships and Grants

- Open a Student or Travel Credit Card

- Create a Budget and Spending Plan

- Apply for a No-Fee Debit Card

- Start Building an Emergency Fund

December:

- Call Your Bank and Credit Card Company

- Review and Finalize Your Budget

- Set Up Online Banking and Alerts

Simone Beilin, Class of 2025, is majoring in economics and minoring in data science.

Want More?

- Everything you need to know about studying abroad.

- Learn about one student’s interning experience abroad

- Read about Kelsey’s summer abroad travels with the Berkeley Symphony Orchestra and her time studying abroad in South America.